Prime Day 2025: Modest growth driven by duration and multi-channel momentum

Key takeaways

Prime Day sales rose modestly year over year, primarily due to the extended four-day event

Multi-channel retail and advertising strategies contributed to higher total ecommerce sales

Mobile accounted for over half of all ecommerce sales during the event

User-generated content (UGC) and influencer marketing had a measurable impact on brand success

Prime Day sales were up slightly year over year, driven by the extended duration

Prime Day 2025 ran from July 8 to 11, doubling the traditional two-day format and giving brands more time to capture sales. Adobe reported that U.S. online retailers saw a combined $24.1 billion in ecommerce revenue during the four-day event, representing a 30.3% increase over last year’s two-day comparable period.

On Amazon, most estimates put Prime Day at modest YoY growth at around 4% to 5% year-over-year lift in total sales volume. This suggests that while top-line growth was achieved, much of it stemmed from having more shopping hours on the calendar rather than stronger per-day performance.

This U-shaped demand curve highlights a few key trends:

Deal fatigue — this year shoppers didn’t rush to Amazon in the way they did previously; however day 1 was still the biggest

Deal FOMO — Sales surge on day 4 as time runs out for the deal period

What does this mean for advertisers?

On multi-day events, plan to distribute budget along this type of demand curve

Retarget late window shopping w/ sponsored display or DSP

Let data guide your decision making, i.e. don’t over invest in products, keywords, or days that have lower conversion

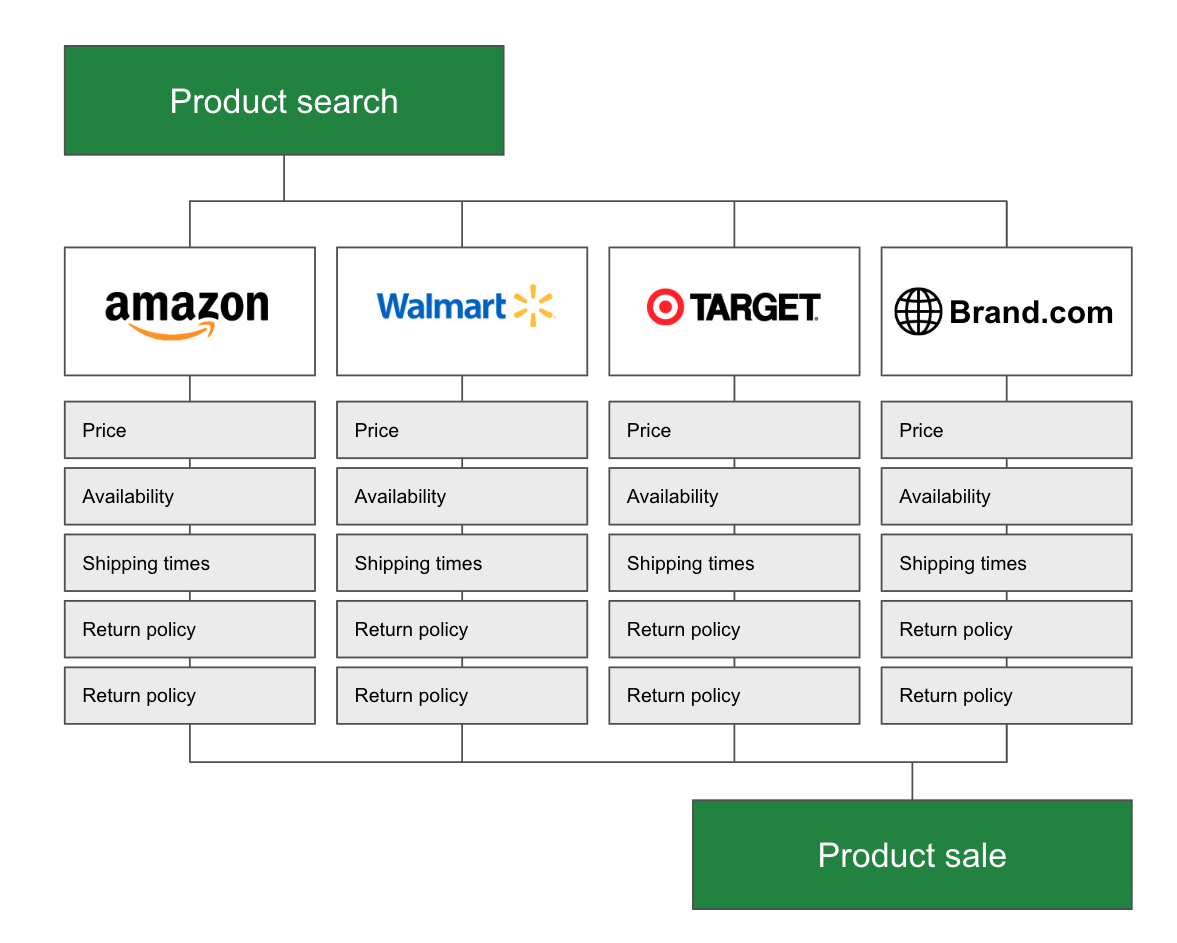

Multi-channel strategies drove higher total ecommerce revenue

Shoppers increasingly engage in multichannel behavior before making a purchase decision. Around 50% of shoppers reported that they shopped across multiple retailers to compare assortment and pricing. We’ve all done it. As shoppers we’re hyper focused on price, availability, shipping, and retailer return policy. This also means that retailer specific promotions, will generate multichannel traffic growth, i.e. Prime Day will cause your Target, Home Depot, and Walmart listings to receive additional bumps in glance views as customers compare. Brands that were ready, and participated in cross retailer promotion, had strong content and availability, and invested in search saw the best results.

All major retailers are making investements to improve their shopping experience. Shoppers are well educated and shop around, even on retail specific event periods.

Having a coordinated, cross-channel retail ecommerce strategy is important to allow you to capitalize on this shopping behavior.

Mobile shopping surpassed 50% of total ecommerce sales this year

Mobile commerce accounted for 53.2% of total ecommerce revenue during the Prime Day period, up from 49.2% last year. That equates to roughly $12.8 billion in mobile-driven sales. Mobile’s growing share reinforces the need for seamless mobile experiences across product pages, ads, brand stores, and influencer-linked content.

Optimizing for mobile is no longer optional, it’s a critical conversion driver.

In the mobile shopping experience, everything above the fold is a sponsored placement.

In order to get seen on mobile you need to make sure you’re winning top of search placements. On these tentpole event periods, make sure you’re setting top of search bid multipliers to make sure your products are visible. Otherwise, you may get washed out in the noise.

UGC and influencer marketing played a major role

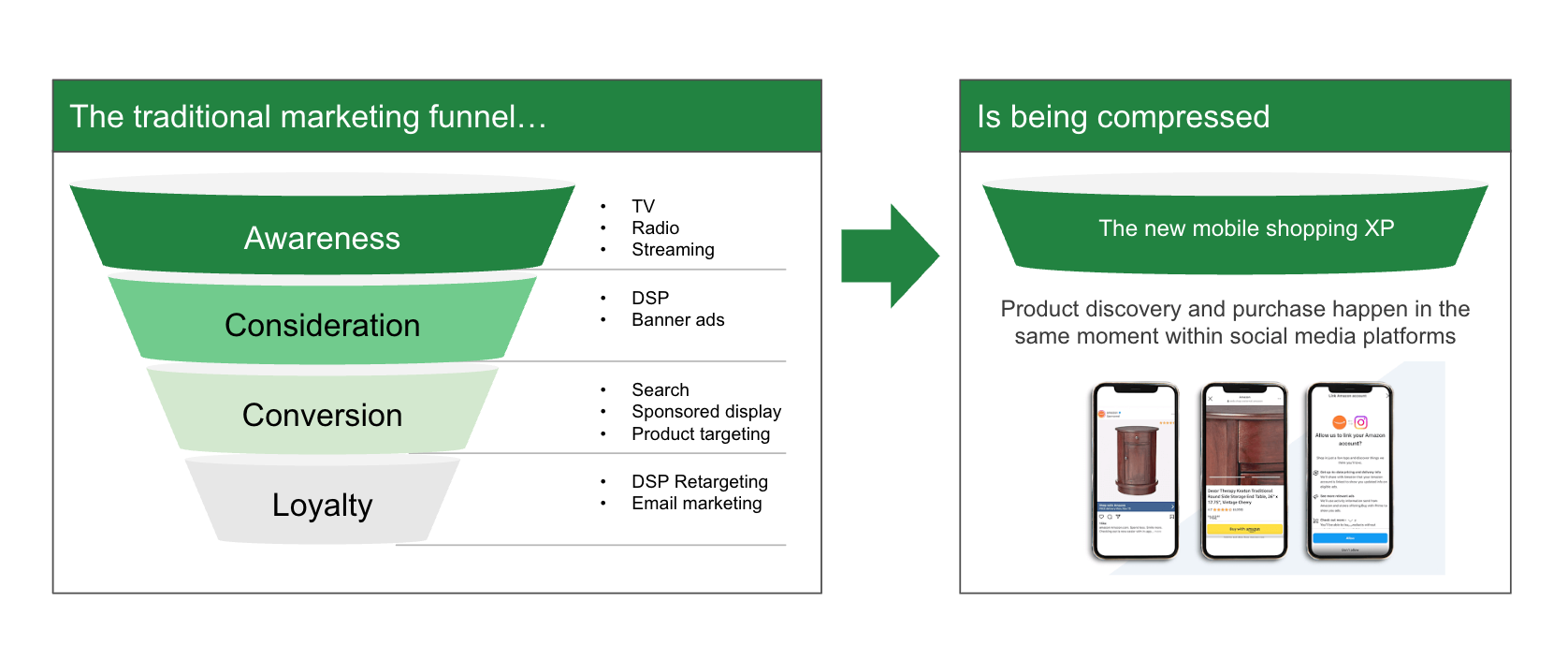

Influencer and user-generated content (UGC) proved to be a key differentiator for many top-performing brands. Adobe reported that influencer-driven affiliate traffic converted at 10 times the rate of standard social media traffic. Meanwhile, Upfluence noted that UGC is perceived as 2.4 times more authentic than brand-created content. Brands that activated creator-led campaigns 6–8 weeks ahead of Prime Day and deployed UGC across PDPs, social channels, and ad placements experienced stronger engagement and sales lifts. This aligns with the broader shift toward authenticity and social proof in ecommerce.

The standard marketing funnel is getting compressed. Customers are learning about products and brands and purchasing their products in the same moment. Amazon has leaned into this with their integration directly w/ meta/instagram. Social commerce isn’t just a niche upper funnel tactic, it is an important channel to consider for your strategy.

As ecommerce continues to mature, the battle for impression, and clicks will continue to get harder. If you’re not already doing it, consider investing in influencer/affiliate marketing in the lead up to your next event. This is only going to continue to become a bigger part of ecommerce strategy.

Based on 2025 Prime Day trends, what should brands be thinking about for the next tentpole event?

Reverse engineer the success based on these key trends.

Invest in upper funnel, especially influencer and user generated content in the 6-8 weeks leading up to the event

Build for the mobile shopping experience

Use top of search bid multipliers to ensure your ads surface on mobile

Review A+ and detail page content to ensure it renders correctly on the mobile screen

Align your budget distribution to the anticipated demand curve for the event (this years 4 day event was a U shape, Turkey 5 this year will most likely follow suit)

If you’re selling on multiple retailers, make sure you have a coordinated strategy across content, pricing, promotion, and retail media

Want help executing your next tentpole event?

Connect with our team today to discuss your coordinated strategy. We’ve worked with brands of all sizes and can help you maximize your results.